Do your eyes start to glaze over as soon as you try to look at a financial statement? The CEO of Skillshare himself – Matt Cooper – comes to the rescue in his Skillshare Original course: “Accounting Fundamentals: Understanding Financial Statements”. This class is for anyone without prior training in accounting, or even those with experience, for that matter. It will help you understand the three main financial statements and how they are interconnected. Read on to learn more about what this course teaches and if it might be able to help you overcome your struggles with financial statements.

Table of Contents

Who is the instructor?

Matt Cooper is the CEO of Skillshare, the platform that hosts this class. He is a former CEO and VP of several companies having also started his career out in the financial industry. As such, he is a legitimate, if not overqualified, instructor for this course. That said, Cooper does a good job to keep things simple and make this course accessible to beginners.

Overview of the content

Getting Started

The class starts by introducing the three financial statements: Income Statement, Cash Flow Statements, and Balance Sheet. Cooper does a good job to get started with easy-to-understand explanations of them and other terms needed later such as accounting, accrual, payables, receivables. Doing so allows the audience to feel like this subject matter may not be as daunting as they may perceive.

Accrual vs Cash Accounting

Next, Cooper talks about two methods of accounting. The first is cash accounting which he likens to using a debit card. It is the most straightforward way to track accounts with transactions being recognized when the money moves. For those a bit older, the analog would be like balancing check book. The second method, accrual accounting, he likens to using a credit card. Cash may not have changed hands, but there is money owed. In this method, there is a difference between when I receive cash and when I can claim the revenue. In the timeless Lemonade stand example, Cooper explains that in accrual accounting, when you buy lemons you create inventory and only recognize it as an expense once it’s been used to make lemonade.

The lemonade stand article is woven in throughout and keeps the subject matter easy to grasp – while its graspable. In the next section, Cooper describes other business models that are not so straightforward which does start to highlight the limitations of this brief course.

Calculating Revenue

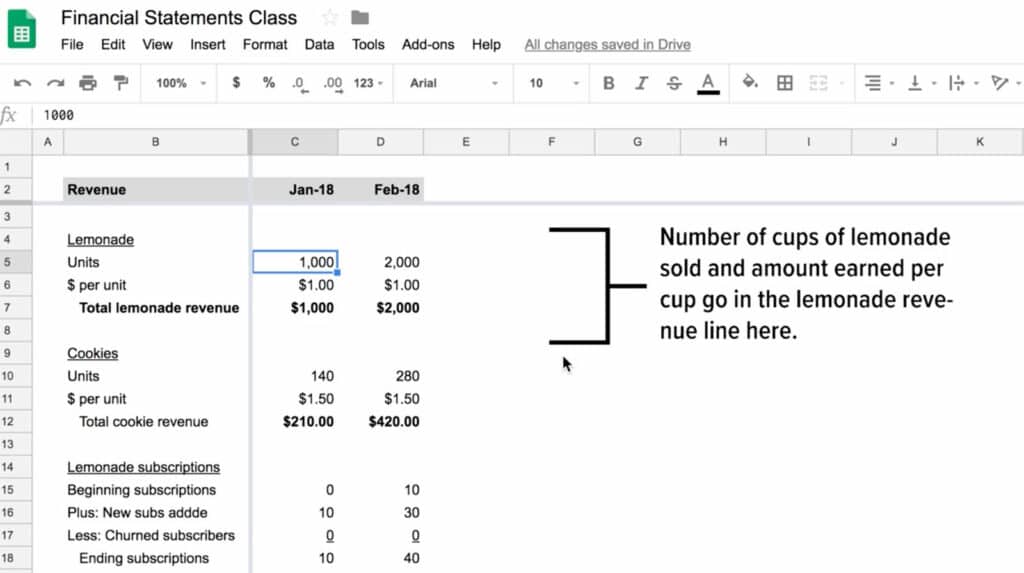

For various business models, the calculation of revenue can differ. This concept is explained by comparing three different ones:

1) Traditional product business: Product quantity x price.

2) Subscription-based business: Beginning subscriptions + new subscriptions – churned subscriptions

3) Consultancy: Hours billed x price per hour

Here, we can see that even the first line of the income statement can get confusing and requires some understanding of both business and its application in accounting.

Income Statement I

Cooper then walks through each section of the income statement in plain language and uses a spreadsheet as a reference. Again, it is the lemonade stand example that is referenced, so those with different business models may have some confusion. When explaining Cost of Goods Sold, he describes it as items most directly related to the production of product sold or services rendered and does not include marketing, administrative expenses etc. I specifically like the example that crystallized it for me: “I can sell lemonade without an accountant or lawyer.”

When covering gross profit, he again highlights the differences between the accrual versus cash methods and how the purchase of lemons would reflect directly on gross profit for the month depending on which method used. This simplified example helps to show the big difference between the two and the importance of taking a course like this to understand it.

Income Statement II

Next, the instructor goes into items below the gross profit line. For those unfamiliar, here are some of the concepts he highlights:

– Sales & marketing: labor, brochures, ads. Example: Kids going out to pass out brochures for lemonade

– Depreciation: physical assets. You pay a certain amount up front and chip away and expense over time.

– Amortization: intangible assets such as a trademark or patents are amortized over time

– R&D: Lemonade testing in a closet. Test lemons. Labor. Other crazy ingredients

From here he describes the difference between operating income and net income – a concept that even famed entrepreneur and billionaire, Richard Branson, supposedly had trouble understanding. Cooper does a good job to be very clear and breakdown each section of the income statement and we have an easy time following along with the lemonade stand.

Balance Sheet & Cash Flow Statements

In this section, he walks through the critical parts of the Balance Sheet. Some of the key concepts here include:

– Assets = Liabilities + Equity

- Current vs. Long Term: Loans between 12 and more than 12 months

- Equity = Paid In Capital, Earnings, etc.

As with the other sections, the annotation in the video helps as he goes along and provides additional context. There were some parts, like the section on Cash Flow Statements, where it would have helped to have even more annotation on the video and focus on the spreadsheet.

In fact, to start this section, Cooper let’s out a small almost indistinguishable sigh. A sign to me that even for him subconsciously, this material is starting to get both confusing and dry. He does a decent job to steer through the concepts of how the cash flow statement aligns the activity from accrual methodology standpoint but ultimately it goes a little too far into the weeds. The lemonade stand example loses focus and this financial statement requires more than 8 minutes to go through.

How much does the course cost?

Courses on Skillshare can not be bought individually – they can only be accessed by signing up for a Skillshare membership. The good news? Skillshare offers e-student.org learners a full month free trial if you use our link (if not using our link, there is normally only a 7-day free trial). As virtually all Skillshare courses will take you less than a month to complete, you can in effect take this or any other Skillshare course for free – or any number of courses that you can finish in a month.

Once your free trial is over, the cost of Skillshare is $165 per year, which averages out to $13.75 per month. This gives you full access to all 34,000+ Skillshare courses. But if you're not happy to continue, you can easily cancel any time before your free trial ends – just go to your payment settings in your account.

If you have no need for a free trial, you can instead get %30 discount on your first year by using this special link instead. With this link, your first year will be just $115.50, averaging out to $9.63 per month. Note that this offer is only valid for new accounts, so it can't be combined with the 30-day free trial.

Conclusion and Recommendation

This course does a great job to breakdown simply and methodically the various financial statements and portions within each. The spreadsheet that is referenced throughout is clear and the added annotations are helpful to keep you engaged.

The running example of the lemonade stand really helps to simplify the understanding of the three financial statements. However, between the limitations due to different business models and perhaps the fact that some of these just need more time to explain, there is some point that the information gets a little fuzzy. In fact, in the conclusion even Cooper says, “hope you’re still awake”. I don’t blame him though as someone who’s sat through many levels of undergraduate level accounting classes, this material is just not going to be that exciting.

With that said, Matt Cooper’s Accounting Fundamentals is a good course to both refresh and introduce the concepts of financial statements and how they interact in a simple and easy-to-consume way.